Mapletree Industrial Trust (MIT) held their AGM on 19 July 2022 at 2.30pm and it ended around 4pm.

Shareholders questions were answered before the actual AGM. You can view MIT responses here.

For the AGM slide, you can view them here.

During the AGM, they highlight their achievement for 2021 (Above) and ESG (Below).

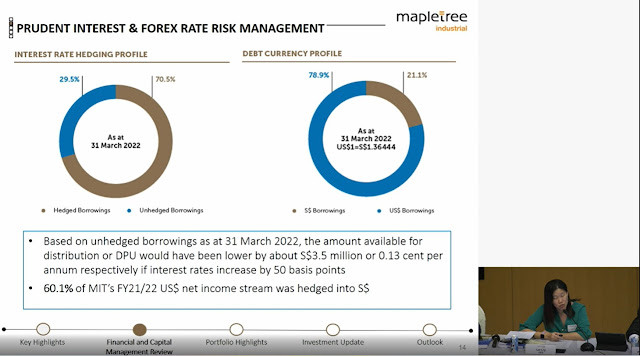

CFO Lily Ler had spent a few minutes on this slide to explain about how the increase in interest rate will affect MIT.

If interest rate increase by 50bps, there will be a decrease of 0.13cents DPU per annual.

At this moment, MIT had a hedge ratio of 70.5%.

CFO also share why MIT did not go into 100% hedge.

1) No room to maneuver when MIT have the opportunity for lower rate. Eg: Divestment cash proceed can be use to pay down the loans.

2) Hedging come with a cost and at this moment, it is at its highest which will affect DPU immediately if were to convert from unhedged to hedged now.

|

| Key and largest acquisition in 2021 |

|

| Outlook |

For the live Q&A session, all questions were answered by either Chairman Wong Meng Meng or/and CEO Tham Kuo Wei except for 1 question which is by CFO Lily Ler.

Some of the questions are:

1) DPU went up by 10% (good job done). Is this 'one off' achievement?

CEO Tham Kuo Wei shared that 10% is rare and wont happen for every year given the size of MIT.

2) With the listing of Digital Core REIT in SGX by Digital Realty, how does it impact MIT?

Chairman Wong Meng Meng shared that US market is huge, there are more than 1 seller. If opportunity is right, even rivals will want to collaborate with us. Business is Business.

After hearing how Chairman Wong Meng Meng & CEO Tham Kuo Wei response to the live Q&A, I remain confidence in MIT (MIT is currently my largest in term of market value in my portfolio with 26,300 shares).

I do not feel both of them trying to sugar coat their responses and was sharing their responses honestly and frankly. CEO Tham Kuo Wei, in a few attempt during his responses, provided his answer based on 2 different perspective. Furthermore, I am surprise by the technical knowledge he use when answering 1 of the question (I am working in IT industry).

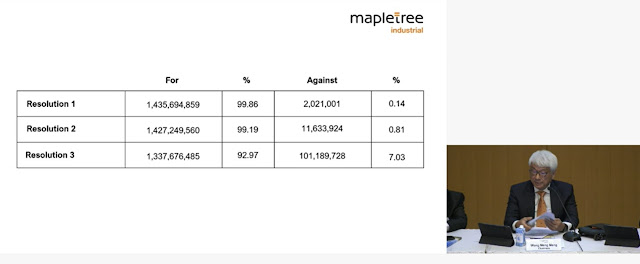

No surprises on the AGM resolution voting.

Related post:

1) Added: Mapletree Industrial Trust (Jan 2022)

2) My thoughts on MCT (Ketchup) x MNACT (Chili) = MPACT (Nacho cheese)

3) Keppel DC REIT AGM 2022

4) Frasers Centrepoint Trust (FCT) AGM 2022

5) ComfortDelGro AGM 2021

6) First REIT AGM 2020

7) MM2 AGM 2019

8) Perennial AGM 2019