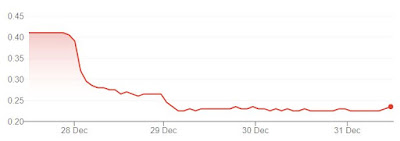

Sold 48,000 shares of FIRST REIT on 28 Dec at $0.36

Bought back 75,300 shares of FIRST REIT on 31 Dec at $0.23

Given the capital remain the same at $48,000 (Bought 24,000 shares @ $1 on 23 Jan & another 24,000 shares @ $1 on 29 Jan) with the above transaction, my FIRST REIT share average price is now $0.64 instead of $1.

If I did not buy back 75,300 shares today, my real loss will be $30,720 (Excluding $2,620.80 of dividend collected and broker + SGX fees).

What is the worst case scenario IF my this buy back stunt goes wrong?

Real loss will be $48,000

Thus, my risk amount here is $17,280

I know many of you cant wait to run as far as you could from FIRST REIT, this CRAZY Mr CDxD still went in to buy.

Reason for buying:

1) OUE Limited committed to be the biggest buyer (winner) for this rights issues

OUE Limited (19.72%) + OUE Lippo Healthcare Limited (10.36%) + First REIT Management Limited (9.36%) = 39.44% of FIRST REIT as at 24 Dec

If OUE Limited have such a high % stake in FIRST REIT and committed to subscribe to all the rights, from we, who is having ikan bilis stake in FIRST REIT, is trying to sell all our shares cheaply away, it doesn't seem OUE Limited would agree to take up such a bad deal if it doesn't benefit them.

DO they know something we doesn't know?

DO they purposely issue the rights at such an undervalue price which they know it will benefit them in the long term?

DO business owners usually think 7 steps ahead or small shareholders is the one that will think 7 steps ahead??

2) Average share price reduce from $1 to $0.64

Rights issues at 20cents & 98 rights units for every 100 existing units

When the announcement came out, people emotion will break lose and gone crazy.

When that happened, SELL button is the most favourite button.

Having rights issues to pay off debt is a big dangerous warning sign.

Having rights issues to buy new asset is the one we should be happy and support it.

Unfortunately, this rights issues is for the former.

Shareholders should already have prepared themselves mentally for possible rights issue (which I did blog about the possibility in Dec 2018, Jan 2019 and Jan 2020).

Similar to the recent Mar 2020 fastest bear market, many investors have been waiting for the bear to come for years.

I wont deny from the facts that remaining in FIRST REIT will cause my shares worth to devalue.

Since I am able to reduce my average cost per share by 36% from $1 to $0.64, why not?

3) No insider selling

OUE Limited have been buying back their shares almost every alternate day since Oct 2020

The situation above is very different from EHT (Eagle Hospitality Trust) where their substantial shareholders keep selling their shares.

4) Restructuring plan is out

Although this is not the best restructuring plan to shareholder, but at least there is a direction ahead.