If you want to be able to withdraw your money from your SRS account at 62 years old, you must make your first contribution to your SRS account latest by 31 Dec 2021.

What is SRS account?

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

What happen if I open SRS account AFTER 1 Jan 2022 onward?

SRS account follow the statutory age of retirement at the point of your first contribution to your SRS account.

The statutory age of retirement in 2021 is 62 years old

The statutory age of retirement in 2022 is 63 years old

The statutory age of retirement by 2030 is 65 years old

This was announced in National Rally 2019 (Link)

How much is needed?

$1

How much time is needed to open SRS account?

Less than 2 mins for me via POSB ibanking.

You can open your SRS account with DBS/POSB, UOB or OCBC

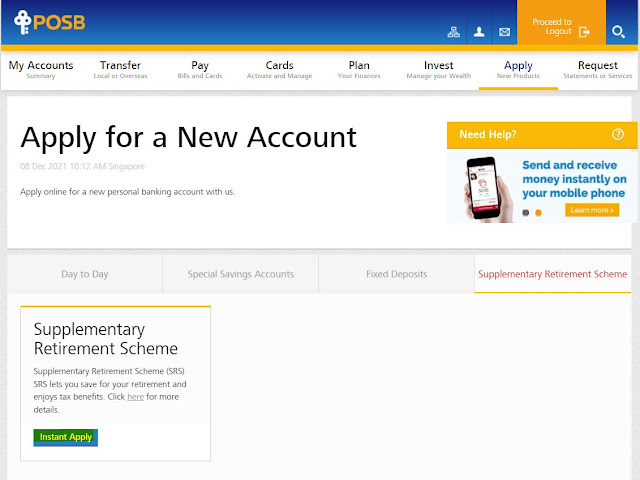

Step 1: Login to your POSB ibanking

Step 2: Click on "Apply" -> "Supplementary Retirement Scheme (SRS)"

Related post:

1) CPF MRSS: dollar for dollar matching up till $3,000

2) Done for 2020 CPF Retirement Sum Topping-up (RSTU). How about you?

No comments:

Post a Comment