In total, I had 21,200 shares of HongKongLand(HKL) in my portfolio.

01 Aug 2019: 10,000 shares at USD6.10 (link)

29 Aug 2019: 2,000 shares at USD5.44 (link)21 Feb 2020: 2,000 shares at USD5.36 (link)

10 Mar 2020: 1,500 shares at USD4.65 (link)

27 May 2020: 4,000 shares at USD3.50 (link)

04 Aug 2020: 1,700 shares at USD3.73 (link)

Average price work out to be USD5.19

Total dividend received: USD9,016

Average price become USD4.76 after including dividends received.

This is the power of dividend while waiting for the price to recover.

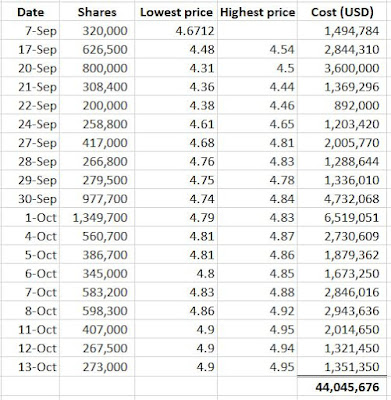

HKL announced share buyback programme on 06 Sep 2021 (Link).

HKL planned to invest up to USD500M till 31 Dec 2022 and shares purchased under in this programme will be cancelled.

HKL share price was USD4.20 on 06 Sep before the announcement was made.

If only 9% (USD44,045,676 out of USD500M) had been used for share buyback and the share price shot up to USD4.93 now, what will the share price be when its utilize 100% (USD500M)??

The Good

1) PB 0.33 only

NAV USD14.75 as of Jul 2021

2) Steady dividend

3) Good credit rating

As of 30 Jun 2021:

S&P 'A' & Moody's 'A3'

We do not want a repeat of China Evergrande to happen to HKL.

Risk

1) Falling net rent and vacancy % increasing in Hong Kong Office Portfolio

No comments:

Post a Comment